Our Investment Philosophy

We hear you. You want the highest returns, with the least amount of risk, within a given timeframe.

The Power of Alternative Investments

Alternative investing offers a world of opportunities beyond traditional stocks, bonds, and mutual funds. With the potential for uncorrelated returns, lower volatility, direct ownership, tax benefits, strong income potential, and passive investment options, alternative assets are an essential consideration for all investors. Accelerated Capital is your gateway to a tax-efficient, diversified portfolio that benefits from inflation and is protected from market crisis and recession.

It’s Time To Invest Like The Smart Money

Institutional investors, like hedge funds, family offices, and endowments, have been investing in stock market alternatives for decades, while individual investors have been beholden to the volatility of the public markets. Private-market real estate investments used to be the exclusive province of institutional investors and the ultra-wealthy. Not anymore. Now, you can manage your wealth without relying the whims of the markets and take control of your money.

Private Real Estate Investing, Simplified.

Take the smart step beyond stocks and bonds. Accelerated Capital makes it simple to build a stronger, more diversified portfolio by providing an avenue for private, institutional-grade investments that offer better returns with lower volatility than the stock market. These investments are shielded from market downturns through innovative structures and proactive risk management strategies. We believe that private equity alternative investments in commercial real estate should be simple to understand, professionally vetted, and accessible to sophisticated investors who want to grow their personal wealth. Welcome to diversified value-add opportunities with high upside potential and downside protection. You invest passively, our experienced team works to maximize your returns.

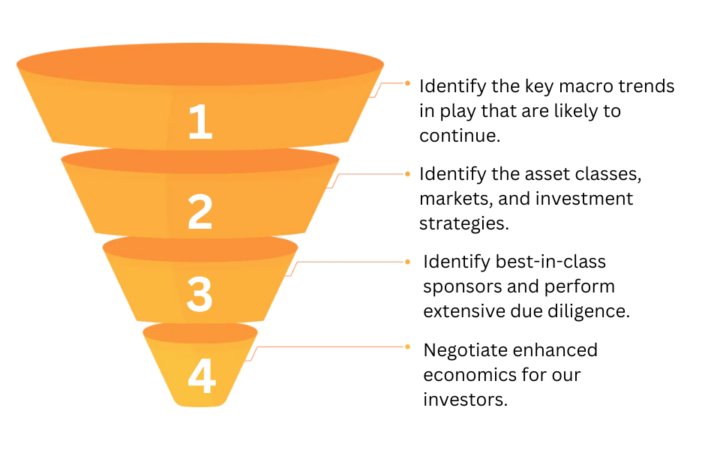

How We Identify Opportunities

Our Investing Criteria

Our core objectives are to protect capital and diversify income sources with top-tier assets and operators. These goals underpin every decision we make, ensuring that every investment not only meets but exceeds our high standards. Every deal you see from us will meet the following minimum criteria:

- Financial Strength: Operators managing $100M+ in assets.

- Track Record: History of success, particularly in economic downturns.

- Specialization: Single-strategy experts for depth of insight & focus.

- Market Edge: Operators with a unique unfair competitive advantage.

- Reliable Income: Focus on steady, recurring returns.

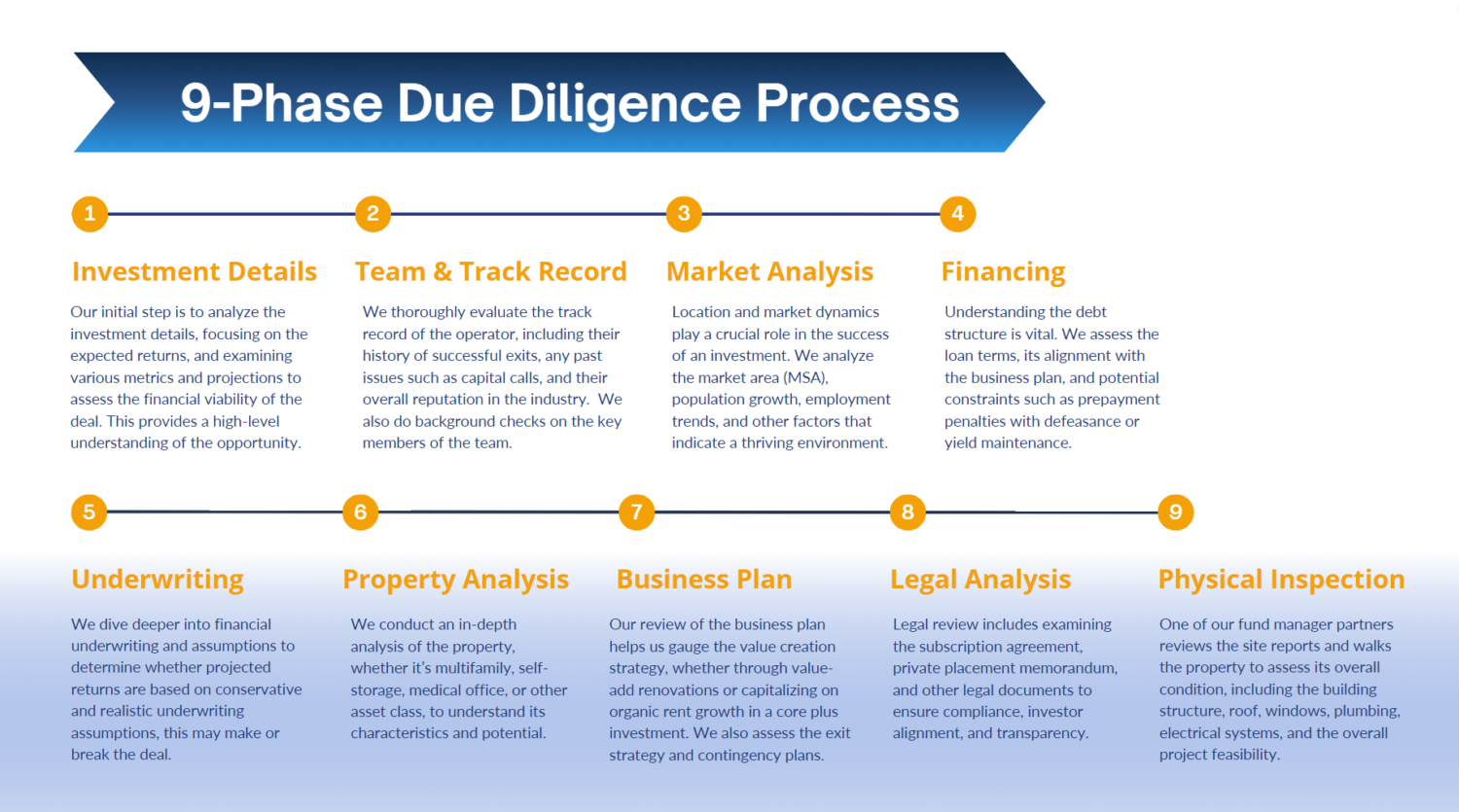

Rigorous Due Diligence & Risk Management

Thorough due diligence is the cornerstone of effective risk management in real estate investment. Our core competency is evaluating operators and opportunities. We find outstanding managers who specialize in one thing and who have a long history of making consistent distributions with a business plan that’s been executed multiple times. The team at Accelerated Capital, plus third parties with specialized knowledge, conducts meticulous research on the operator, property, underwriting, and financial projections.

Our proven 220-point due diligence process is designed for weeding out the average and finding the best. We meticulously vet each operator, ensuring they meet our strict criteria for performance, integrity, and alignment of interests. This commitment to excellence allows us to offer investment opportunities that deliver attractive and consistent returns while minimizing risk and maximizing value for our investors. Enjoy superior risk-adjusted returns through our institutional-quality investments, and our in-depth due diligence backed by qualitative and quantitative risk management performance measures. That said, we always suggest conducting your own due diligence.

Investor FAQ

What makes Accelerated Capital’s investment opportunities unique?

Accelerated Capital streamlines real estate investing for self-directed investors like you. Instead of managing “tenants, trash, and toilets,” you can choose from curated, highly vetted investments. Our investment opportunities stand out due to our rigorous 220-point due diligence process. This ensures that each investment is thoroughly vetted for financial viability, market trends, and long-term potential. Our approach focuses on delivering high-quality, secure, and strategically sound real estate investments, specifically tailored for busy entrepreneurs and high-net-worth individuals. Build a diversified real estate portfolio and gain access to the types of high-upside commercial real estate that used to be inaccessible to individual investors.

What is a syndication?

A syndication is when a group of people combine their money to purchase an investment. We find and vet investment opportunities then reach out to our network and present it. If you’re interested in investing in a syndication, fill out this form and we’ll be in touch.

Why do you focus on private-market CRE investments?

- Attractive risk-adjusted returns.

- Has historically outperformed during inflationary periods.

- Can offer a blend of income, appreciation, and tax benefits.

- Is a more stable investment with a low correlation to stocks and bonds.

- Has historically had a more attractive risk-return profile than public REITs

- Tends to steadily appreciate based on the cash flow, the improvements made to the property, and trends in the local real estate market.

Why multifamily and why now?

With apartment demand at a high point and homeownership rates at their lowest in two decades, multi-family has the highest risk-adjusted returns in real estate. Multifamily investments also exhibit inherent resilience during economic downturns.

- Inflation is persisting.

- Home affordability is at an all time low.

- There is an extreme lack of housing supply.

- People always need a place to live.

Will there be a crash in Multifamily?

While it’s true that real estate, like any investment, carries inherent market risk, multifamily properties tend to be more resilient than other types of real estate assets, such as single-family homes or commercial properties. The demand for rental housing often remains stable even during economic downturns, providing a reliable income stream for investors. Additionally, diversification across multiple properties and geographic locations can help mitigate market risk. The problem is with properties purchased in the last 2-3 years that have floating rate debt and no rate cap. Those may go back to the bank or get snatched up by a savvy operator. Operators buying now are penciling in higher rates.

What’s the difference between investing in a Syndication vs. investing in a REIT?

Syndication investments are targeted, private ventures shielded from the volatility of public market fluctuations, whereas REITs are publicly traded entities, making them more susceptible to market volatility. A real estate syndication is a direct investment of private investor capital into a real estate property as a limited partner. REITs do not offer investors the tax benefits that are available to direct owners of real estate.

Are investments guaranteed?

Investments are NOT guaranteed. Moreover, real estate investments are highly illiquid because of long hold periods, and investors should only commit an amount that they are comfortable with potentially losing.

Why invest in multifamily which comes with more inherent risks if I can get 5% with no risks?

Ultimately, the decision to invest in multifamily real estate over cash depends on an investor’s risk tolerance and investment goals. Cash provides stability, while commercial real estate offers the potential for higher returns. We deliver risk-adjusted double-digit returns through value-add investment offerings. These investments have more risk associated, but offer the potential for upside through cash flow, tax benefits, and asset appreciation.

What are the risks associated with investing in commercial real estate and how are they mitigated?

One significant risk in real estate investing arises from potential shifts in interest-rate policies by the Federal Reserve, which could elevate capital costs. We proactively mitigate this by ensuring our deals possess a substantial cash flow safety margin to cushion against rising interest rates and sponsors have 18 months of cash reserves to navigate unforeseen challenges. There is also a certain amount of risk inherent in operating the property, which is why it is important to invest with experienced operators that can mitigate many of the risks involved. Our team provides an independent underwriting of each project with conservative projections, we thoroughly vet each operator partner with our 220-point due diligence process, and conduct market analysis. Diversification across sponsors, locations, and asset types are also effective at mitigating risk.

How does my involvement as a limited partner impact my liability?

Every asset is safeguarded within its individual LLC (Limited Liability Company). This structure confines potential liabilities and litigations strictly to that specific asset. Just like lenders, limited partner (LP) investors aren’t deemed as operators, thus they’re insulated from liabilities stemming from operational setbacks.

How do you identify the markets you invests in?

We choose markets with strong economics and demographics. We look at;

- Population Growth

- Job Growth & Diversity

- Low Supply / High Demand

- Pro Business & Development

What types of assets do you look for?

We target well-located, underperforming, B-class, core and core plus, multifamily assets, below market value, with a value-add component, lucrative upside potential, and downside protection. We are also looking at mobile home parks, self-storage, and senior living facilities in the south and sunbelt regions. We target assets that are too large for small investors and too small for large investors so the competition is less.

What is the average holding period?

We typically target a hold period of 3–5 years, although some deals may target as long as 10 years. The hold period is defined as the time between when the underlying property is acquired and when that property is sold and its proceeds are distributed to investors.

What is the minimum investment?

The minimum investment threshold stands at $50,000 for most of our opportunities, however we can sometimes accept $25,000. On more expensive properties, the minimum investment amount may be higher.

What is an accredited investor?

To be an accredited investor, you must meet one of the following criteria:

-

Net worth greater than $1 million, not including personal residence

-

Annual income greater than $200,000 for the past two years with the expectation of the same income in the current year ($300,000 if including spouse’s income)

-

There are other criteria, but they are not common

Do I have to be an accredited investor to invest?

No. Non accredited investors can also invest in our syndications, though there are more opportunities for accredited investors. To invest as a non-accredited investor, fill out this form and we’ll be in touch.

How can I invest?

Traditional cash investment: Investing after-tax money allows you to take full advantage of the depreciation benefits of owning real estate – without the hassle of to becoming a landlord yourself.

Self-directed IRA or 401(k): Clients may have a large portion of their net worth locked up in retirement plans. You can work with a custodian to roll a portion of your retirement account into a self-directed IRA, allowing them to invest in real estate to diversify your retirement accounts. We have recommendations on groups to work with if you’re looking for a self-directed IRA custodian to guide you through the process.

1031: We can accept 1031 exchanges into our projects if you want to take real estate where you are an active owner and exchange into passive ownership through our opportunities. The minimum equity investment for 1031s is $500,000 to $1 million, depending on the sponsor.

Request to join our private investor club to access highly vetted real estate opportunities here https://acceleratemycapital.com/invest/

How do I learn about opportunities?

First, we need to have a conversation to understand your investment goals, then we’ll add you to our investor list and can officially present an offering. Usually, we host a webinar to announce the new investment opportunities. Join our investor club and stay informed about the webinar announcements.

How does the waitlist work?

Once indicated interest exceeds our total allocation, we create a waitlist. Investors who indicate interest while a deal is active reserve their place in the investment and may fund their investment up until the funding deadline. Investors who indicate interest in a waitlisted investment will be invited to participate in the deal on a first-come, first-served basis, should an allocation become available.

What kind of returns can I expect?

Accelerated Capital’s investments target attractive double-digit total returns. In general, you can expect to receive around 15% average annual returns over the course of the investment. Because these investments are illiquid and managed by experienced, vetted real estate operators, they carry the potential for “alpha” — attractive total return as a function of management skill and asset quality. Investment objectives will vary by offering and typically target some degree of mid-term cash flow in addition to an equity gain.

I’ve heard investing in real estate brings certain tax advantages. Can you tell me more?

Real estate investments are very tax-friendly, primarily because they can take advantage of depreciation which can result in a “paper” loss on your investment statement even if you’ve earned significant returns. In some cases, this paper loss can also offset other investment gains or even your personal income on your tax returns. You will benefit from your portion of the investment’s deductions for property taxes, loan interest and depreciation. We also like to use a cost segregation strategy to accelerate depreciation. It’s not unusual on a $100k investment to return actual cash in your pocket of $8k while experiencing a paper loss on your annual K-1. That loss can then be used to offset other income. At time of sale the partnership gains are treated as long-term capital gains and then rolled into another syndication to mitigate the gains. You should discuss your personal situation with a qualified tax professional.

What types of regular communication should I expect?

Investors can anticipate monthly or quarterly email updates detailing the progress of fund projects. Additionally, investors have access to a secure portal to view investment returns, subscription agreements, taxes, and distributions.

How does Accelerated Capital make their money?

The first thing to understand is that any fee is separate from all highlighted returns and projections for a deal. Simply put, that means that any fee collected by Accelerated Capital has no impact on projected returns of the deal. We make our money in two ways;

- A Due Diligence fee, which is typically 2% to cover all costs associated with finding and vetting the deal, (and to keep the lights on).

- An Equity split, which is the split of equity when the property sells or is refinanced. Typically, the equity split is 90/10, 90% to investors and 10% to Accelerated Capital.

Where can I find definitions of terms I’m unfamiliar with?

See our glossary of real estate investing terms here https://acceleratemycapital.com/glossary/

“Our investment philosophy is not based on waiting for a storm to pass. It’s about dancing in the rain.”

“When it’s raining gold, reach for a bucket, not a thimble.” – Warren Buffett