The Designer Investment Product of the Financial Class

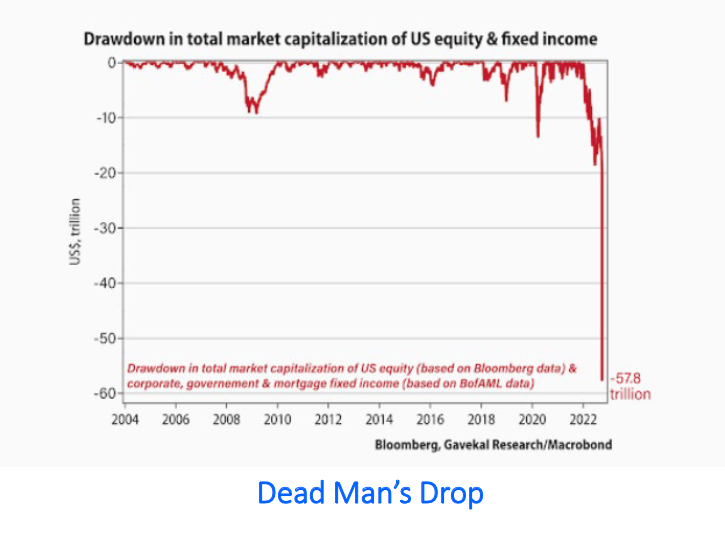

The global financial landscape has undergone a seismic shift. As of Q4 of 2022, global equity and fixed-income markets have shrunk by a staggering $58 trillion, as pointed out by Gavekel and Bloomberg research. This dramatic loss mirrors the devastating financial collapse of 1929 but with a 21st-century global twist. Alarmingly, this might just be the tip of the iceberg.

For over a decade, the Federal Reserve has shielded capital markets and investors from massive, overdue market corrections. Now, the Fed is stuck between two dire situations: the skyrocketing inflation caused by its interventions after the 2008 crash and the economic depression looming if market-driven interest rates are reinstated.

Since 2017, on a mark-to-market basis, the Fed has been bankrupt. Its ability to intervene and stabilize global markets is dwindling rapidly. This isn’t a repeat of past financial crises. The financial system today is saddled with vast amounts of low-yield assets. Therefore, any significant increase in interest rates by the Fed could spell disaster, pushing the financial system into insolvency.

For now, the Fed might resort to minor, short-term interest rate hikes. However, a tidal wave of financial imbalance threatens to burst the dam the Fed built, risking assets and net worth worldwide. This could unleash an unprecedented global hyper-stagflation scenario.

While uncertainty prevails, savvy investors are bracing for a massive market crash. This is no replay of 2008; seasoned institutional investors ($100M+) have learned from the past and are poised to weather the storm and even profit from it. They’ve focused all their expertise and resources to become the beneficiaries of everyone else’s losses. They’re not going to achieve this by betting on any one strategy or asset class but by increasing their allocation of alternatives and leveraging designer financial products, notably GP stakes.

The Rise of GP Stakes

GP stakes funds, which are anticipated to be worth around $530 billion, are gradually becoming accessible to a few outside elite financial circles, such as Blackstone Strategic Capital Partners, Neuberger Berman’s Dyal Capital Partners, Adagio Capital Management, and Goldman Sachs’ Petershill. A select group of knowledgeable high-net-worth investors now has a chance to dip their toes into this complex investment pool.

But why the buzz around GP stakes? These financial tools offer the potential for extremely high returns, regardless of market conditions. They inherently have limited availability, making them all the more coveted, even among institutional players. Retail investors might find them elusive, but those who do gain access might discover a goldmine with unparalleled risk-adjusted returns.

To grasp this, consider the select financial elite. Only about 10% of the U.S. population are accredited investors, and a mere 1.5% are qualified purchasers. Those with liquid assets exceeding $100 million navigate an entirely different financial realm, offloading risk to the masses. This is the birthplace of GP stakes.

So, what exactly are GP stakes? Dive into the world of private investment funds (like hedge, private equity, or venture capital funds). They pool capital from various investors to function as a unified private investment entity.

The fund manager, often referred to as the GP (general partner), manages these investments. They typically earn through a blend of management and performance fees. Occasionally, ownership in the GP can be sold, allowing buyers a slice of these lucrative fees, which can yield impressive annual returns.

Every GP stake deal is unique and hinges on the interplay between the investor’s contribution and the asset manager’s requirements. Successful investors in this realm possess:

- Mastery of quantitative risk analytics.

- Sharp evaluation skills for operational efficiency.

- Negotiation expertise for intricate deals.

- Proficiency in navigating financial firm structures.

- Competence in marketing financial products, ensuring legal and regulatory compliance.

Given their potential, dedicated funds, known as GP stakes funds, have emerged to invest exclusively in GPs. These funds come with their own terms and conditions, often locking in investments for extended periods, anywhere from 2 to 10 years.

Fees associated with fund managers often draw criticism, particularly during downturns when investors bear losses while managers continue to earn. GP stakes turn these fee structures into elite investment opportunities, now inching within reach of astute, inquisitive, and sophisticated accredited investors.

Leave a Reply

Want to join the discussion?Feel free to contribute!