Passive Real Estate Investing Terminology

Before you dive headfirst into the world of commercial real estate investing, though, it’s important to understand the key terms that come along with it. To get you started, Accelerated Capital compiled a list of important terms that a commercial real estate investor—whether new or a seasoned pro—should know.

A

Absorption Rate

The Absorption Rate is a measure of supply and demand in the commercial real estate market, most often segmented on a per-sector basis. In short, the absorption rate is the difference between the total square footage (sq. ft.) of vacated space and the newly leased space by tenants within a set time frame, relative to the initial total amount of space marketed as available for lease.

Acceleration Clause

A clause in a contract that allows a lender to demand full repayment or partial repayment of an outstanding loan if certain requirements are not met by the borrower.

Accredited Investor

An accredited investor is an investor who meets the SEC requirements [1] for income or net worth including meeting one of the following criteria:

- Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

What does being an accredited investor allow you to do?

Most security offerings, private equity, hedge funds, and syndications only allow accredited investors to participate in their offerings. Categorizing accredited investors helps the SEC prevent inexperienced and uninformed investors from being taken advantage of and to protect those ill-equipped to handle greater financial risk.

Accrued Interest

Accrued interest is an accounting term denoting the amount of interest incurred, but yet to be paid, as of a specific date. Investors need to include accrued interest in their debt calculations to ensure they determine the correct cash flow after repayment.

Alternative Investments

Investment categories other than traditional securities or long-only stock and bond portfolios; they include hedge funds, venture capital, private equity, and real estate. Alternative investments often employ strategies typically unavailable to long-only managers, such as the use of derivatives, the ability to short, and the ability to hold illiquid assets.

Amortization

Amortization is the process of spreading a cost, typically related to the repayment of a loan’s principal amount, into sequential payments over a set number of periods. Amortization is used by lenders to set a schedule of repayment. An amortized loan allows investors to pay off the loan principal over varying lengths of time.

Apartment Syndication

An apartment syndication is a temporary professional financial services alliance formed for the purpose of handling a large apartment transaction that would be hard or impossible for the entities involved to handle individually, which allows companies to pool their resources and share risks and returns. In regards to apartments, a syndication is typically a partnership between general partners (i.e. the syndicator) and the limited partners (i.e. the investors) to acquire, manage and sell an apartment community while sharing in the profits.

Asset Allocation

Asset allocation encompasses the distribution of investment capital within a portfolio across various investments, strategies, sectors, or other methods of categorization. Asset allocation is often used to define the strategic or tactical approach investment managers take to accomplishing a portfolio’s given mandate in regard to risk, return, and diversification. Asset allocation is used by investment managers to diversify risk and return across the universe of investment options and strategies.

Average Annual Return (AAR)

The average annual return (AAR) is a percentage used when reporting the historical return, such as the three, five, and 10-year average returns of a fund.

B

Basis Point

A basis point (bps) is equal to 1/100th of 1% or .01% and is a common unit of measure for interest rate changes.

Bonus Depreciation

Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery, rather than write them off over the “useful life” of that asset. Bonus depreciation is also known as the additional first-year depreciation deduction. This is an excellent, legal way of writing off your cash flow distributions. Please consult with your CPA.

Bridge Loan

A bridge loan is a short term loan that is used while a person or company gets permanent financing or removes an existing financial obligation. These are short term loans backed by collateral, typically the underlying property in the context of real estate, and have relatively high interest rates while providing immediate cash flow.

C

Capital Call

A capital call is a legally enforceable ask from a private equity entity to their limited partners (i.e., investors) for a portion or full amount of the committed capital to be transferred to the fund. Fund managers regularly use capital calls to use on an as-needed basis to collect capital when an asset needs funding. Capital calls usually facilitate purchasing new investments or carrying out strategic project initiatives at specific assets.

Capital Expenditures (CAPEX)

Capital expenditures, typically referred to as CapEx, are the costs to renovate, upgrade, or repair an asset, often through a commercial property management company. An expense is considered to be a capital expenditure when it improves the useful life of an apartment and is capitalized – spreading the cost of the expenditure over the useful life of the asset.

Capital expenditures include both interior and exterior renovations.

Examples of exterior CapEx are repairing or replacing a parking lot, repairing or replacing a roof, repairing, replacing or installing balconies or patios, installing carports, large landscaping projects, rebranding the community, new paint, new siding, repairing or replacing HVAC and renovating a clubhouse.

Examples of interior CapEx are new cabinetry, new countertops, new appliances, new flooring, installing fireplaces, opening up or enclosing a kitchen, new light fixtures, interior paint, plumbing projects, new blinds and new hardware (i.e. door knobs, cabinet handles, outlet covers, faucets, etc.).

Examples of things that wouldn’t be considered CapEx are like the costs associated with turning over a unit (i.e. paint, new carpet, cleaning, etc.), ongoing maintenance and repairs, ongoing landscaping costs, payroll to employees, utility expenses, etc.

They are used by investment or operation managers to increase the long-term value of an asset. CAPEX is often capitalized and not categorized in the same manner as operating expenses on a balance sheet.

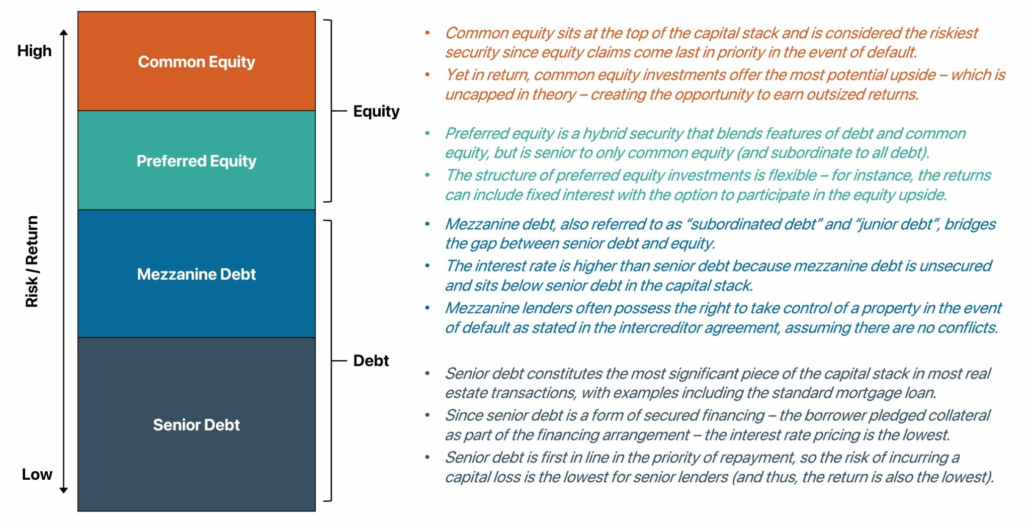

Capital Stack

The capital stack represents the types and distribution priority of capital used to finance a transaction. Typically the capital stack will be made up of debt and equity positions, with debt structures sitting in a higher priority position than equity classes.

The capital stack is an important point of reference to determine the priority in which distributions are returned to investors and financiers. The capital stack also displays the order of priority in which creditors and equity holders will be repaid in the event of liquidation.

Capitalization Rate (Cap Rate)

The capitalization rate or cap rate is a formula for dividing the property’s market value by the current operating expressed in a percentage. The cap rate is calculated by dividing the property’s net operating income (NOI) by the current market value or acquisition cost of a property.

Net Operating Income / Asset Market Value = Cap Rate

Here is an example:

If an investment property reports an annual NOI of $450,000 and it’s assumed market value is $6,000,000 then the property’s cap rate is 7.5%

A cap rate is a metric to assess an investment property’s potential profitability and return before bringing in mortgage financing. In other words, investors use it to determine their potential initial yield.

When evaluating a property, it’s important to look at the cap rate based on all-in costs, including all fees, to get a realistic picture of the potential return on investment. It’s also important to evaluate the exit cap rate, which reflects the assumptions regarding future market conditions and property performance. A conservative exit cap rate that accounts for potential market fluctuations is important for ensuring a realistic assessment of future value.

Cash Flow

Cash flow is the revenue remaining after paying all expenses. Cash flow is calculated by subtracting the operating expense and debt service from the collected revenue

| Total Income | $1,879,669 |

| Total Operating Expense | $1,137,424 |

| Debt Service | $581,090 |

| Asset Mgmt Fee | $40,195 |

| Cash Flow | $120,960 |

Cash on Cash Return (COC)

A cash on cash return is a ratio showing the total cash earned (before taxes) to the total capital invested.

For example:

Annual Pre-Tax Cash Flow / Total Cash Invested into the Property = COC

An investor purchased a 20-door apartment complex for $2M with a downpayment of $400,000 and $10,000 in closing costs.

The complex achieved a rental rate of $1,000/unit and maintained an 80% occupancy rate, earning $192,000 of annual rental revenue. The apartment complex is also earning $2,000 in parking fees and $1,000 from laundry services.

Gross Revenue = ($192,000 + $2,000 + $1,000) = $195,000

The annual property management fee is $9,000, the annual maintenance fees are $20,000 the annual insurance costs $5,000, the property pays $4,000 in property taxes, and the annual mortgage payment is $130,000.

Annual Cash Outflow: ($9,000 + $20,000 + $5,000 + $4,000 + $130,000) = 168,000

Annual Pre-tax Cashflow: $195,000 – $168,000 = $27,000 (annual cash inflow-annual cash outflow)

$27,000 / 410,000 = 6.59%*

*expected first year cash on cash return

Cash on cash returns are usually shown in percentages to determine the annual cash flow back to the investment entity. Investors often use COC as a metric to determine future cash yield potential.

Cash-Out Refinance

A cash-out refinance is the process of restructuring a loan so a property owner can convert equity in the property into cash, effectively increasing the loan principal to be paid down.

Property owners use cash-out refinance for several reasons:

- to free up capital for new investment opportunities

- to reduce interest expenses

- to distribute capital to investors

- to renovate or expand the property

Clawback Provision

The carried interest received by the General Partner (GP) that must be returned to the Limited Partners (LPs) from not meeting the minimum hurdle rate.

Closing Costs

Closing costs are the expenses, over and above the price of the property, that buyers and sellers normally incur to complete a real estate transaction. Examples of closing costs are origination fees, application fees, recording fees, attorney fees, underwriting fees, credit search fees and due diligence fees.

Concessions

Concessions are the credits (dollars) given to offset rent, application fees, move-in fees and any other revenue line time, which are generally given to tenants at move-in.

Core

Core real estate refers to investment properties that are considered stable and low-risk. These properties are typically located in prime locations, such as central business districts or well-established residential areas. Core properties are known for their stable cash flows, high occupancy rates, and long-term lease agreements with creditworthy tenants. They are often characterized by their high-quality construction, strong asset management, and reliable income generation.

Core Plus

Core plus real estate involves properties that have similar characteristics to core properties but may require additional strategic improvements or proactive management to enhance their value. These properties often offer a slightly higher risk profile compared to core properties, but also present the potential for higher returns.

Investing in core plus real estate can be an opportunity for investors seeking a balance between stable income and growth. These properties may have higher vacancy rates or shorter lease terms compared to core properties, but they also offer the potential for increased cash flow and appreciation through active management and light capital improvements. Core plus investments are ideal for investors looking for some degree of total return potential while maintaining stability and strong cash flows from rent.

Cost Segregation Study

A cost segregation study surveys a building’s subcomponents, like lighting fixtures, heating and air conditioning systems, and other components that deteriorate over time. It assigns five- or 15-year lifespans to these subcomponents. The process is conducted by a trained professional to identify assets and costs of a property and classify their useful life for tax purposes. This is used for reducing current tax liabilities by reallocating depreciation beyond a straight-line schedule.

D

Debt Service

Debt service is a property’s total payment on its debt obligations on a monthly or annual basis. Debt service can change over time if a loan has a variable rate or if there is an interest only (IO) period. Debt service is used in several financial calculations to account for the cost of financing an asset.

For example, a 24-month $11,505,500 loan with 5.28% interest amortized over 30 years results in a debt service of $60,977 per month.

Debt Service Coverage Ratio (DSCR)

Debt service coverage ratio (DSCR) is a financial measurement of the property’s ability to generate cash flow to fund the cost of its debt obligations. DSCR is usually expressed as a multiple.

NOI / Total Debt Service = DSCR

Lenders use the Debt Service Coverage Ratio to evaluate if an asset can support a specific debt load. Many lenders want to see a DSCR greater than 1.2x. If an asset’s profitability is not able to maintain a 1.2x DSCR, the Lender may reduce the amount of debt capital made available.

Defeasance

Defeasance is a provision in a contract that voids a bond or loan on a balance sheet when the borrower sets aside cash or bonds sufficient enough to service the debt. The borrower sets aside cash to pay off the bonds; therefore, the outstanding debt and cash offset each other on the balance sheet and do not need to be recorded.

In the multifamily and commercial financing industry, there are a variety of ways that a borrower can potentially reimburse their lender for prepaying their loan. Common prepayment penalties include yield maintenance, step-downs, and soft-step downs. However, defeasance, another common type of prepayment penalty, is also often an option, particularly for CMBS loans, as well as for certain Fannie Mae® and Freddie Mac® multifamily loans.

In many cases, a borrower will have to choose between yield maintenance and defeasance as loan prepayment penalties. This is often the case when it comes to CMBS loans. Choosing between these two options also depends on the exact terms of a lender’s defeasance agreement. Defeasance is usually the optimal choice when bond interest rates are compounded monthly and payments are calculated to the maturity date (and when the overall yield maintenance prepayment penalty is greater). In contrast, yield maintenance is typically more optimal if bond interest rates are compounded annually and payments are calculated to the loan’s prepayment date (and when the overall yield maintenance prepayment penalty is smaller).

Depreciation

Depreciation is an income tax deduction that allows commercial property owners to write off a portion of the property’s value each year to account for its physical deterioration and decrease in value. Property owners use depreciation to offset rental income and reduce tax liability.

Discount Rate

The discount rate is the rate used to find the present value of future cash flows. Investors use the discount rate to determine the current value of an asset’s potential future cash flows. It often represents opportunity costs, inflation, and risk of ownership during the hold period. Investors use it to determine if a property will meet or exceed a targeted return over its lifetime of ownership.

Distressed Assets

Distressed assets are properties that are priced below market value. Distressed assets are typically priced lower than the market value due to the seller having an immediate need for cash because the property is underperforming. This type of underperformance is typically caused by one of several issues: deteriorating physical condition, mismanagement, a flawed pricing structure, a short-term issue out of the owner’s control, macroeconomic shocks (like a pandemic), or too much debt due to an issue with the capital stack.

Investors look for distressed assets because they offer an opportunity to purchase properties at a discount, which can lead to a higher return on investment. That said, there is a risk that the distressed asset needs expensive repairs or other fixes—so not every distressed asset will end up a good investment.

Downside Protection

As an alternative asset, real estate can serve as a strong addition to a portfolio when diversifying for downside protection. Because private real estate is highly uncorrelated to the stock market, its value is not affected by the same volatility or economic downturns. This means that a portfolio will be less affected by short-term fluctuations or losses if the stock market declines, as it continues to earn dividends on the long-term investments. As investors benefit from alternative asset allocation on a high level, they can also diversify within real estate, with each additional investment further diversifying their risk profile.

Real estate also acts as a hedge against inflation, mitigating the risk of losses associated with the decreasing purchasing power of money. Because property values tend to stay on a steady upward curve over time, and higher home prices often equal higher rent, real estate investments can provide recurring income that keeps pace with or exceeds inflation in terms of appreciation. During inflationary periods, investors may consider allocating to private real estate as a method of downside protection.

Due Diligence

Due diligence is a framework by which investors “do their homework” on a potential investment property (and potentially the sponsor, or lead investor) as they determine whether or not to invest. The depth and timeframe for real estate due diligence varies, but the goal is to determine whether the property and investment are sound.

Real estate due diligence may refer to either the sponsor’s (or anchor investor’s) evaluation of the property in considering purchase, or LP investors considering whether to invest alongside the sponsor in the property. Therefore, the diligence process may examine the following elements of the real estate investment, among others: Rental or sales comparables (“comps”) in the neighborhood and metro; the physical condition of the property; vacancy rate, rent rolls, and other aspects of the property’s pro forma; demographic trends and demand drivers in the metro; capitalization (cap rate) dynamics in the metro; and, in the case of an LP investor deciding whether to invest alongside a given sponsor, the LP investor may examine the track record and operating history of the sponsor.

E

Escrow Agreement

The escrow agreement is a legal document that outlines the terms of the escrow arrangement between the sponsor and the investor. It includes information about how the investor’s funds will be held until the syndication is fully funded.

Equity Multiple

An equity multiple is a ratio showing the total cash distribution received divided by the total equity invested.

Total Profit / Total Value of initial investment = Equity Multiple

An equity multiple is used to evaluate the total earning power over the full lifecycle of an investment in relation to the amount of capital invested, without regard for the length of the investment period.

Here is an example:

If an offering projects an equity multiple of 2.50x the investment would return $2.50 on every $1.00 invested for the full period of the investment (I.e., not on an annual basis).

Equity Value

The Equity Value at an specific point in time can be determined by taking an asset’s market value and then deducting any debt or liabilities that would need to be paid off in the event of disposition. Equity value is used to determine an investor’s potential profit on the sale of a property as the delta between the equity capital used to acquire and operate the asset and the Equity Value at present represents the investor’s potential gain on sale.

Equity Waterfall

An equity waterfall is a structure outlining the process and priority for the return of capital and cash flow distributions on a project or a fund to all classes of equity investor in the deal. Investment managers use equity waterfalls to explain to investors the priority and process for capital return and profit distribution.

F

Financing Fees

Financing fees are the one-time, upfront fees charged by the lender for providing the debt service. Also referred to as a finance charge. Typically, the financing fees are 1.75% of the purchase price.

For example, a 216-unit apartment community purchased for $12,200,000 will have an estimated $213,500 in financing fees.

Fund of Funds (FOF)

A fund of funds is a pooled investment fund that invests in other types of funds. A fund of funds offers diversification in asset types or classes as well as in asset managers, locations, strategies and vintages.

Typically, FOFs attract investors who want to get better exposure with fewer risks compared to directly investing in securities—or even in individual funds. Investing in a FOF gives the investor professional wealth management services and expertise.

FOF investors enjoy Due diligence on fund selection (which can be particularly beneficial due to the dispersion of returns among funds and managers)

Investing in a FOF also allows investors with limited capital to tap into diversified portfolios with different underlying assets. Many of these would be out-of-reach for the average retail investor.

G

General Partner (GP)

The general partner (GP) is an owner of a partnership who has unlimited liability. A general partner is also usually a managing partner and active in the day-to-day operations of the business. In apartment syndications, the GP is also referred to as the sponsor or syndicator. The GP is responsible for managing the entire apartment project.

Gross Potential Income

The gross potential income is the hypothetical amount of revenue if the apartment community was 100% leased year-round at market rates plus all other income.

For example, a 216-unit apartment community with a GPR of $183,072 and monthly other income of $14,153 from late fees, pet fees and a RUBS program has a gross potential income of $197,225 per month.

I

Internal Rate of Return (IRR)

Internal rate of return is financial metric, usually represented as a percentage, that uses the time value of money to compute the annualized rate of return for an asset over a specific period of investment. The metric stands as the primary way real estate finance equity investments are judged. The higher the IRR, the more desirable the investment.

IRR is used to determine an investment’s annual rate of return which can be particularly useful when cash inflows and outflows vary from period to period over the life of an investment. IRR allows investors to essentially smooth out the lumpiness in cash flows to understand the annual rate of return of a particular investment and to compare this return with other investments that may too have irregular cash flows.

Investor Questionnaire

The investor questionnaire is a document that helps the sponsor determine whether an investor meets the legal requirements to invest in the syndication. It includes questions about the investor’s financial status, investment experience, and risk tolerance.

K

K-1

A K-1 is a federal tax statement that reports each investor’s share of income, losses, deductions and credits in a fund or investment structure. Investors use the information from their K-1 to file their tax returns.

As a partner in the LLC that purchases the properties, you will receive a K-1. A K-1 is a tax form used by partnerships to provide investors with detailed information on their share of a partnership’s taxable income. Partnerships are generally not subject to federal or state income tax, but instead issue a K-1 to each investor to report his or her share of the partnership’s income, gains, losses, deductions and credits. The K-1s are provided to investors on an annual basis so that each investor can include K-1 amounts on his or her tax return.

L

Loan to Cost (LTC)

Loan to cost (LTC) is a ratio similar to LTV, but which incorporates the cost of construction and improvements in addition to asset value. LTC is typically used in place of LTV when financing is being sought to cover an amount and scope greater than solely the purchase of an asset. LTC is usually expressed as a percentage.

Loan Amount / (Asset Purchase Price + Construction Costs) = Loan to Cost

Loan to cost is used by Lenders to size debt financing for a project. Investors use the ratio to help determine the amount of equity needed for the acquisition and construction and/or improvement of an asset. The LTC ratio is important because it’s one of the metrics that underwriters use to determine whether an investment project is fundable.

The higher the LTC, the riskier the project is to lenders—and if an LTC ratio is too high, the real estate investment firm may have a tough time securing funding for the project. For example, if the total cost of a real estate investment is $2 million and the investor needs to borrow $1.8 million, the LTC would be 90%, which is an LTC that most lenders will avoid.

Loan to Value Ratio (LTV)

Loan to value ratio (LTV) is a metric measuring the magnitude of debt being used to finance an asset relative to the price of the asset.

Loan Amount / Purchase Price of Asset = Loan to Value Ratio (LTV)

Loan to value ratio is used by lending institutions to size their debt financing on an asset. Riskier assets will typically receive financing terms at lower LTV’s. Investment managers also use the ratio to determine the needed down payment for a property and to estimate the servicing and financing costs of the debt being considered.

Letter of Intent (LOI)

A letter of intent or LOI is a non-binding document between a commercial real estate buyer and the seller outlining the terms in which they intend to transact.

A letter of intent (LOI) is used by commercial real estate buyers to express their firm interest in purchasing a property. The document is not legally enforceable, and, in most cases, it only starts official negations between the two parties.

Loss to Lease (LTL)

Loss to lease (LTL) is the revenue lost based on the market rent and the actual rent. LtL is calculated by dividing the gross potential rent minus the actual rent collected by the gross potential rent.

For example, a 216-unit apartment community with a GPR of $183,072 and with an actual rent of $157,270 has a LtL of 14%.

Limited Partner (LP)

A limited partner (LP) is a passive investor who holds an equity interest in an investment vehicle. Whether the investment is a syndicated deal, a fund, or a Special Purpose Vehicle, the LP’s make up the non-managing equity partners in the transaction.

The primary responsibility of a Limited Partner is to fund their capital commitment(s) in accordance with the process laid out in their investment documents.

M

Management Fee

The periodic payment paid to the general partner (GP) by the limited partners (LPs) to cover the costs of managing the fund, such as administrative expenses and overhead.

Mezzanine Debt

Mezzanine debt is a form of “gap” or “bridge” financing for real estate transactions. As part of a more complex capital stack, a sponsor may utilize senior debt, mezzanine debt, preferred equity, and common equity. In a “mezz debt” structure, the lender the right to convert to an ownership or equity interest in the investment opportunity if the loan is not paid back in time and in full. It differs from preferred equity in the sense that mezzanine debt requires a pledge of equity.

For example, an investor purchases a property for $8 million and obtains a senior loan for $5 million, along with another $2 million in equity from investors. In this case, by obtaining a $1 million mezzanine loan, it would bridge the gap between the financing from the senior loan and equity and complete the capital stack necessary to make the property purchase.

Depending on the commercial real estate (CRE) project, mezzanine debt can offer flexibility and enhanced overall return potential to the borrower, while offering an attractive rate of return to mezzanine debt investors over a relatively short investment term. Participating in mezzanine debt positions generally offers higher average target returns than senior debt, and mezzanine investors typically earn a 10% to 20% return on their investment.

Modern Portfolio Theory

Modern portfolio theory is a method of investing that risk-averse investors use to build a diverse portfolio with assets that will maximize profit while keeping the overall risk as low as possible. In other words, it’s a way to build a portfolio that maximizes the returns and minimizes the risks by diversifying the investments. This theory is used to build diverse portfolios for all types of investments, including real estate investing. For example, rather than investing in properties in the same neighborhood or market, investors using modern portfolio theory would spread their investments across a wide range of property types and markets. That way, if one of the investments in their portfolio underperforms due to changing market conditions in one area, the other diverse investments would protect the investor from having huge losses across the board.

A key pillar of modern portfolio theory is achieving low “cross-asset correlation”—diversifying across types of investments that don’t move in lockstep in terms of returns. For example, diversifying into private real estate, whose returns historically have not correlated closely with the stock market.

Multifamily Investing

A real estate investing strategy that focuses on properties suitable for multiple tenants, like an apartment complex or condominium. Multifamily investing typically refers to investing in properties with a large number of units so that economies of scale and greater total return can be achieved.

N

Net Operating Income (NOI)

Net Operating Income or NOI is the annual revenue a property generates after all operating expenses have been taken into account but before taxes (aside from property taxes) are subtracted.

Property’s Gross Income – Operating Expenses = NOI

Here is an example:

If an RV Park is generating $120,00 from seasonal bookings, $10,000 from nightly bookings, and $5,000 from its general store then the total annual revenue for the park would be $135,000.

$120,000 + $10,000 + $5,000 = 135,000

The park also has $2,000 of yearly maintenance costs, $15,000 of payroll expenses, $2,200 in property taxes, and $3,000 of insurance costs.

$2,000 + $15,000 + $2,200 + $3,000 = $22,200

The RV park’s NOI would be:

$135,000 – $22,200 = 112,800

NOI is used for a myriad of purposes:

- Investors use NOI to determine the current value of the property and if the investment property could be profitable with future renovations, management expenses, and loan service

- Lenders use NOI when calculating the debt coverage ratio (DCR) and determining their willingness to extend a loan for the project

- Sellers use it as the main marker in their OM to show the profitability of their property during the sale

Net Present Value (NPV)

Net Present Value is the result of calculations that compute the current value of a future stream of cash flows, using a proper discount rate.

As Net Present Value takes into account the magnitude and timing of cash flows along with the project’s appropriate discount rate for those future cash flows, it can be used to determine whether a project is worth undertaking.

O

Operating Agreement

The operating agreement outlines the structure and terms of the partnership between the sponsor and investors. It includes information about the general partner’s responsibilities, the limited partners’ rights, and how profits will be distributed.

Offering Memorandum

A commercial real estate offering memorandum (OM), also known as an investment memorandum or a private placement memorandum (PPM), is a tool used to introduce prospective buyers or investors to the property and is vital in presenting your sale opportunity, credibility, and professionalism.

Opportunistic Deal

Opportunistic deals are those in which a portion of the risk and return profiles are defined by adverse or extenuating circumstances which hold the potential for upside if reconciled such as foreclosure, mismanagement, disrepair, death, etc. These deals are characterized by their higher degree of risk and need for effort and or experience to turn them around in order to achieve higher potential upside.

Opportunistic deals are classified as real estate projects with higher levels and/or unique risk but with the potential for significantly higher returns. Complicated return strategies, including heavy value-add, development, or repositioning, are signs of opportunistic deals.

P

Pari Passu

Pari passu is a term used by real estate and legal professions meaning “equal footing.” In the real estate sector, pari passu clauses are usually used in waterfall structures to dictate that the investment partners will receive equal payouts proportionally to their initial investment until a return minimum has been reached.

Passive Real Estate Investing

Passive real estate investing is a strategy whereby an investor puts money into a real estate venture but isn’t actively involved in the day-to-day management or decision-making of the property or properties.

Personal Guarantee

A personal guarantee is when a financier requires a personal commitment from the sponsor to be liable for a specified amount of the debt in case of default. Lenders often ask for a personal guarantee if they have any concerns about the sponsoring entity’s credit history, track record, or financial stability, or if the project to be financed is particularly risky.

Physical Occupancy

Physical Occupancy measures the number of vacant units in a real estate property, relative to the total number of units in the rental property, expressed as a percentage.

Preferred Equity

Preferred equity is an equity investment with priority over common equity in the capital stack, typically considered less risky that other subordinate classes of equity, but more risky than debt. Preferred equity is often structured such that investors receive a fixed return at a rate higher than most debt in the capital stack, but without the upside potential of more risky common equity.

For example, let’s say an investor has purchased a multifamily building for $9 million dollars with the help of a $6 million loan from a senior lender, a $2 million bridge financing from a preferred equity investor, and a $1 million loan from other investors. At some point, the property underperforms and is sold for just $8 million. The senior lender would be repaid first, and the private lender with preferred equity is prioritized—leaving nothing leftover to repay the lenders with common equity in the property.

Preferred equity is often used to fill debt funding gaps in the capital stack and as a means to attract capital from risk-averse investors willing to forego upside participation for downside protection and distribution priority over common equity holders.

Preferred Return (“Pref”)

A preferred return is a profit distribution structure in which a minimum return must be distributed before the sponsor can collect a performance fee. Private equity groups often use preferred return structures to create a high level of confidence in the investment and to be incentivized to make the investment as high-yielding as possible to ensure a sponsor return. Once the limited partners (LPs) are “made whole” and recouped their original capital investment, the subsequent tier is the preferred return (or “Pref”). The preferred rate usually ranges between 6% to 8% on an annual basis, while based on the internal rate of return (IRR) accrued.

Price per Unit

Price per unit is the cost of purchasing an apartment community based on the purchase price and the number of units. The price (or cost) per unit is calculated by dividing the purchase price by the number of units.

For example, a 216-unit apartment community purchased for $12,200,000 has a price per unit of $56,481.

Private Placement Memorandum (PPM)

A private placement memorandum (PPM) is a legal document that highlights the term and conditions of a real estate offering. A private placement memorandum (PPM) is given to a potential real estate investor to review the structure, projected returns, terms, and risks of an offering before investing.

Pro Forma

A pro forma is a financial statement that documents a property’s key financial metrics, including but not limited to NOI, cash flows, operating expenses, improvement costs, and rental rates. A pro forma is used by investors to project potential future profit on an asset. Investors use the specified assumptions and financial metrics to forecast how changes in assumptions affect financial performance.

Promote (Carried Interest)

The promote is essentially a profit share that the general partner (GP) earns above their proportional equity contribution. The promote is earned only after all investors have received their initial capital contribution and a predetermined preferred return. Often used interchangeably with carried interest (or “carry”), the promote is a performance-based contingency payment and can be thought of as the reward earned by the general partner (GP) for meeting the pre-determined return target.

Purchase & Sale Agreement (PSA)

A purchase and sale agreement or PSA is a legally binding statement that includes the terms and conditions in which a buyer and seller will transact. The PSA also spells out courses of remedy and remediation if the transaction runs afoul. A purchase and sale agreement is a contract to bring the seller and buyer of a commercial property to an agreement on the terms of a property sale. It usually defines terms including the sale price, title information, due diligence period, escrow period, warranties, and any contingencies.

R

Real Estate Investment Trust (REIT)

A real estate investment trust or REIT is a company that owns, operates, or finances a diverse set of income-producing real estate across various property sectors. Most REITs are registered with the SEC and are publicly traded on an exchange. REITs operate much like mutual funds but are subject to strict guidelines such as a) the requirement to derive at least 75% of gross income from rents, mortgage interest, or real estate sales proceeds b) REITS must pay at least 90% of their taxable income in the form of shareholder dividends each year c) must have at least 100 shareholders after its year of inception

Real estate investment trusts or REITs allow individual investors to invest in real estate by purchasing shares which give them exposure to a diverse portfolio of real assets. REITs enable individual investors to invest in real estate with the added benefits of liquidity and diversification, however, REITs may trade below their NAV and do not pass many of real estate ownership’s tax advantages on to investors.

Reg. D; 506 (b)

The company may collect money from an unlimited number of “accredited investors” and up to 35 “sophisticated investors.” Investments are not available to the general public.

Reg. D; 506 (c)

The investors in the offering are all “accredited investors”; and the company takes reasonable steps to verify that the investors are “accredited investors.”

Real Estate Investment Trust (REIT)

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool capital investors who earn dividends from real estate investments. Investors do not individually buy, manage, or finance any properties.

Return on Investment (ROI)

Return on Investment (ROI) is the net value of returns produced by an investment divided by its cost, usually expressed as a percentage.

ROI = Net Return of Investment / Total Cost of Investment

Here is an example:

An investor buys a property valued at $500,000. They pay a $100,000 down payment and $5,000 in closing costs. They also pay $12,000 for upgrades and renovations.

Their monthly mortgage payment is $1,900 or $22,800 annually

The investor rents the property for $3,000 a month or $36,000 a year. They spend $1,000 on insurance costs and $500 on maintenance costs annually.

The property’s net return for the year would be:

$36,000 – ($22,800 + $1,000 + $500) = $11,700

The property’s ROI would be:

$11,700/ $117,000 = 10%

ROI is used as a metric for evaluating an investment’s ability to produce returns in relation to the capital allocated to the investment.

Risk-Adjusted Return

Risk-adjusted return is a measure of profit or potential profit that takes into consideration the risk inherent in achieving such a return.

Risk-adjusted return is used by investment managers to evaluate an investment’s return or potential return in the context of the risk incurred in achieving that return. In this manner an investment manager can compare investments with different risk profiles in order to determine which produces the best return per unit of risk assumed.

S

Senior Debt

Senior debt is secured by a mortgage or deed of trust on the property itself. If the borrower fails to pay and defaults on the loan, the lender can take title to the property. This potential default significantly reduces risk because, at worst, the lender owns the property and will look to maximize value by selling the property or selling the non-performing loan.

Sensitivity Analysis

Sensitivity analysis in real estate syndication is a method used to predict the outcome of a project based on varying inputs and assumptions. This technique involves adjusting key factors, such as rental income, occupancy rates, financing costs, and operating expenses, to see how changes in these variables affect the overall return on investment.

For example, a sensitivity analysis chart in Excel for a real estate investment property might show how the property’s net operating income (NOI) changes as the property’s vacancy rate and rental rate are varied. The chart would allow the user to see how the NOI changes at different vacancy and rental rates, and identify the optimal range of values for these variables.

Sophisticated Investor

A sophisticated investor is an individual who is non-accredited but has enough knowledge and experience in business matters to evaluate the risks and merits of an investment but doesn’t meet the financial requirements of an Accredited Investor.

Sponsor

Often referred to as general partners (GPs) or syndicators, sponsors use their expertise and knowledge to source, structure, manage, and optimize multifamily properties. Their role is multifaceted, encompassing strategic planning, decision-making, risk mitigation, and investor relations.

Special Purpose Vehicle (SPV)

A Single Purpose Vehicle, also known as a Special Purpose Vehicle is a legal entity created for a specific, narrow, and well-defined purpose. An SPV is often used to pool together investments from multiple investors to invest in a particular property or company. The SPV essentially acts as a conduit for investors to collectively invest in a single deal, without having to become direct shareholders in the target company.

Stabilization

Stabilization typically occurs when a property achieves a consistent and sustainable level of occupancy, expenses, and revenue following either construction or significant renovation. Once a property is built and receives its Certificate of Occupancy, it may take months or years for units to be leased up and for operations to normalize, at which point it would be considered stabilized.

Stabilization periods are used by investment managers account for and anticipate the time it will take a property to achieve target occupancy following construction or renovation. Buyers use a pro forma based on stabilized periods to determine acquisition prices and lenders use it to set loan parameters. A typical stabilization period includes when a property has achieved 80% occupancy for a full calendar quarter.

Strategic Asset Allocation

Strategic asset allocation is the practice of holding a defined portfolio allocation – with respect to asset classes – over a sustained period of time to achieve long-term goals, tailored to specific risk tolerance, investing time horizon, and return objectives. Most financial advisors and investing experts recommend “rebalancing” asset allocation over time, in a disciplined fashion, to maintain the strategy.

Subscription Agreement

The subscription agreement is a legal document that formalizes an investor’s commitment to invest in the syndication. It includes information about the investment amount, payment terms, and representations and warranties made by the investor.

Syndication

Real estate syndication is a partnership of investors who collectively buy larger assets that may be unmanageable or expensive for individual investors. Usually, 25–30% of funds originate from both the syndicator and passive investors, while 70–75% comes from a lender or bank.

There are many parties involved in a syndication, including, but not limited to, CPAs, lenders, real estate brokers, attorneys, property managers, passive investors and the syndicator who puts the whole deal together and manages the asset.

T

T12

A T12 report in real estate, also known as a TTM or trailing twelve months, is a financial report that breaks down the income and expenses for your investments over the previous twelve months.

Total Returns on Equity

Total returns on equity is the total return on investment, including cash flow and appreciation on the initial capital that is distributed to equity investors after debt and other liabilities are covered. Investment managers use total returns on equity to compute various performance metrics specific to equity positions in the capital stack.

V

Vacancy Rate

The Vacancy Rate refers to the percentage of unoccupied units relative to the total number of rental units available at a property over a specified period.

Value-Add Deal

A value-add deal is an investment opportunity that aims to increase profitability through capital improvements and the creation of other income drivers. Value-add deals typically aim to expand a property and/or to reposition a property. Common value-add strategies include but are not limited to expansion, upgrading amenities, interior and exterior renovations, outsourcing management, renegotiating contracts, and developing other income drivers.

Vertical Integration Vertical integration is a strategy that allows a company to streamline its operations by taking direct ownership of various stages of its production process rather than relying on external contractors or suppliers.

W

Waterfall

A Real Estate Waterfall is a tier-based model for measuring the proper distribution of proceeds between a general partner (GP) and its limited partners (LPs). The pecking order via which the distributable proceeds of a fund (or “profits”) must be issued and the timing of each payoff is established by the equity waterfall.

American Waterfall (“Deal-by-Deal”) The general partner (GP) receives carried interest on a per-investment basis, irrespective of the fund’s performance as a whole (or individual performance of other holdings).

European Waterfall (“Whole Fund”) The general partner (GP) collects carried interest only after the requirement for the original capital contributions, inclusive of fund fees and expenses, are returned in full to the limited partners (LPs) is met.

Y

Yield Maintenance

Yield maintenance is a sort of prepayment penalty that allows investors to attain the same yield as if the borrower made all scheduled interest payments up until the maturity date. It dictates that borrowers pay the rate differential between the loan interest rate and the prevailing market interest rate on the prepaid capital for the period remaining to loan maturity.

Yield maintenance premiums are designed to make investors indifferent to prepayment (the settlement of a debt or installment loan before its official due date). Furthermore, it makes refinancing unattractive and uneconomical to borrowers.

Yield on Cost (YOC)

Yield on Cost determines how well a property is cash flowing compared with the total cost of the project, including purchase price, renovation dollars spent, transaction fees, etc. Essentially, it’s a metric that determines the actual impact of the business plan by calculating how much yield the investment is generating after implementation.

- If the YOC is projected to be low (less than 7% for Class B multifamily) after the property has been stabilized, then the business plan is likely not very effective.

- If the YOC is projected to be high (over 8% for Class B multifamily) after the property is stabilized, then you know the dollars spent doing those renovations will be worth it.

Stabilized YOC is a great way to determine the likelihood that your projected dividend will get paid once the business plan has been accomplished.

.

[1] https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor